RBA’s rate cut on Tuesday (June 4, 2019) marks the first change to cash rate since August 2016, pushing the official cash rate to its historically low level of 1.25 per cent.

This move is a result of weak international trade growth, weak income growth and ‘negative wealth effect’ from house price falls, which together subdue household consumption and slow down the economy. The RBA stated that the cut was “to support employment growth and provide greater confidence that inflation will be consistent with the medium-term target”.

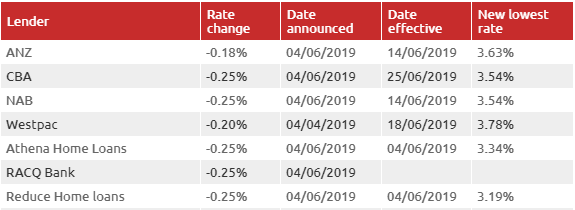

In response to RBA’s announcement, CBA, NAB, and three smaller banks (Athena Home Loans, RACQ Bank, Reduce Home Loans) all passed on the full 25-basis-point cut to customers, bringing their “lowest interest rate” to approximately 3.5%. Meanwhile, Westpac passed on only 20-basis-points and ANZ only 18-basis-points, equivalent to 70% of the lower-funding-cost benefits banks receive as a result of RBA’s decision.

If banks have passed on the full 25-basis-points, a borrower with a $500,000 mortgage would see their repayments fall by $73 per month. Correspondingly, this cut is likely to ease repayment burden for home loan holders, majority of whom are on variable-rate loans.

Together with APRA’s proposed amendment to mortgage lending guidance, this move from RBA is expected to bring good signs to the property market by enhancing debt serviceability and improving individual’s housing purchase capacity.

Moreover, it may trigger investors to return to the housing market through a greater access to credit and a higher net present value of future rental income. A recent RBA research found that cash rate cut is the primary driver of the pre-2017 property boom, where a one percentage point decrease in official interest rates boost housing prices by 8 per cent in the following two years.

Economists expect a second 25-basis-points cut in coming months, likely in August, which will push the cash rate down to 1.0 per cent. Meanwhile, JP Morgan predicts the cash rate to be as low as 0.5 per cent by mid-2020, following RBA’s four future rate cuts.

In conclusion, RBA’s rate cut on Tuesday and future rate cuts are expected to generate relatively positive impacts on housing prices and bolster the fundamentals of Australia’s property market.

Disclaimer: The information contained in this article is for information sharing purpose only and does not constitute financial, accounting, or legal advice. The content provided is general in nature. This material does not constitute advice and you should not rely on any material to make (or refrain from making) any decision or take (or refrain from taking) any action. Before making any decisions, you should consider whether the information is appropriate to your objectives, financial situation and needs.